Charitable Contribution Deductions 2024

Charitable Contribution Deductions 2024. For example, if you want to claim a charitable contribution on your 2023 returns (which you’ll file in april 2024), you will need to make that donation by december. Credits, deductions and income reported on other forms or schedules.

The limits on charitable contribution deductions can significantly impact an individual’s or business’s tax strategy, making it an essential topic of discussion. Moving into 2024, further changes have been made to the tax laws affecting charitable contributions deductions.

Updated April 14, 2024 12:02 Pm Et.

In return for your payment you receive or expect to receive a state tax credit of 70% of your $1,000 contribution.

Report Your Charitable Donations And Claim Your Tax Credits When You File Your Income Tax Return.

The contribution is deductible if made to,.

That Means You'll List Out All Of Your.

Images References :

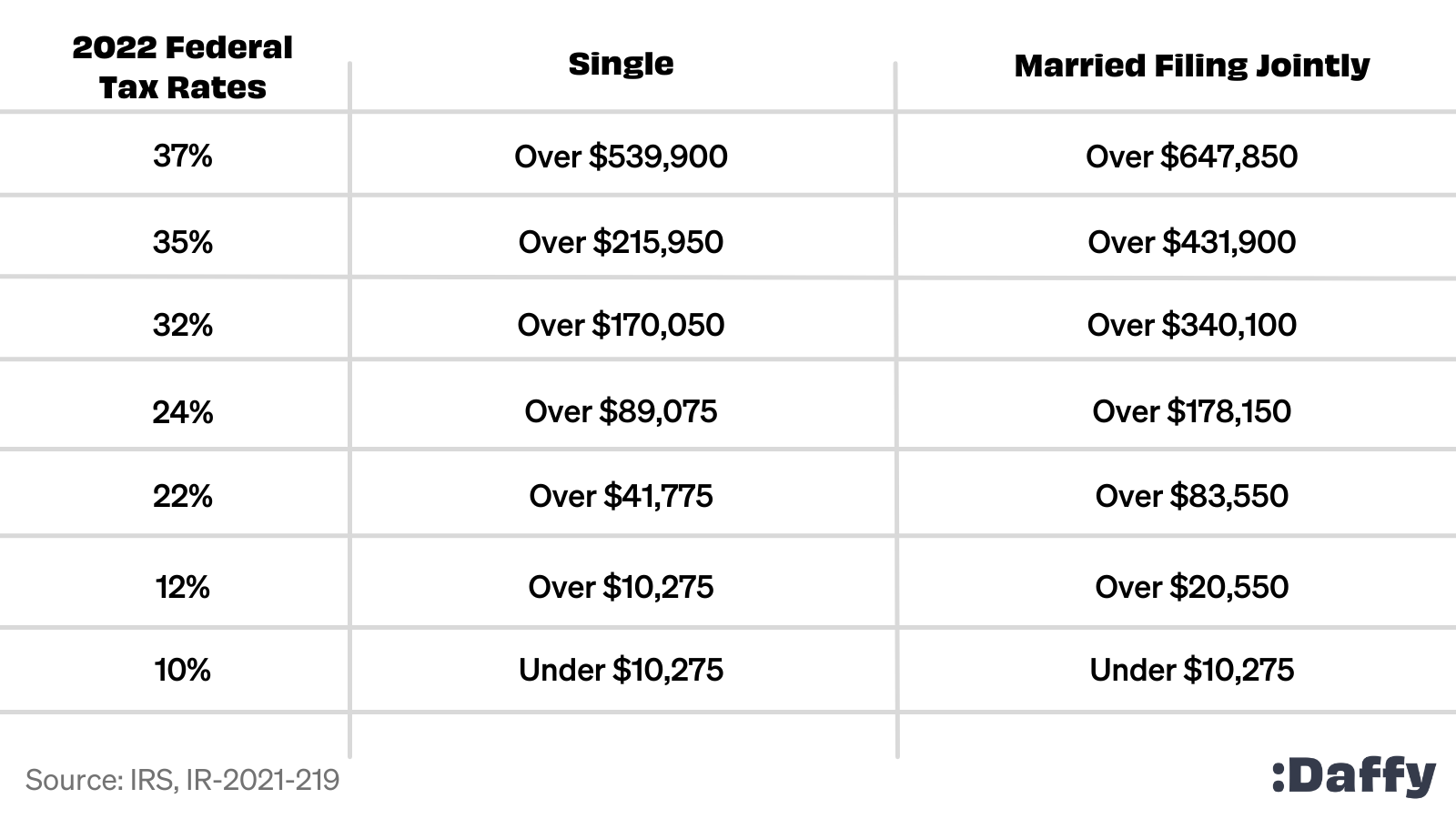

Source: daffy.ghost.io

Source: daffy.ghost.io

The Complete 2022 Charitable Tax Deductions Guide, That means you'll list out all of your. For more information, refer to publication 526.

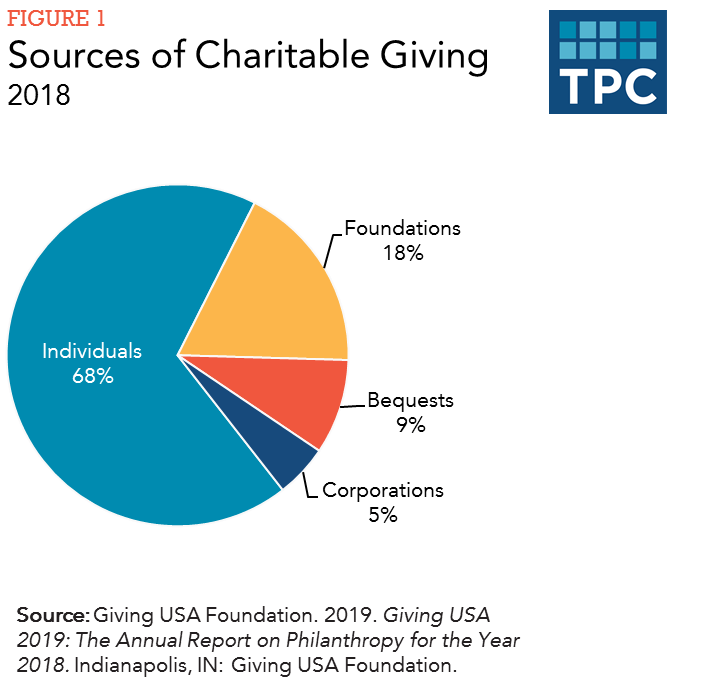

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

Who benefits from the deduction for charitable contributions? Tax, Updated april 14, 2024 12:02 pm et. Report your charitable donations and claim your tax credits when you file your income tax return.

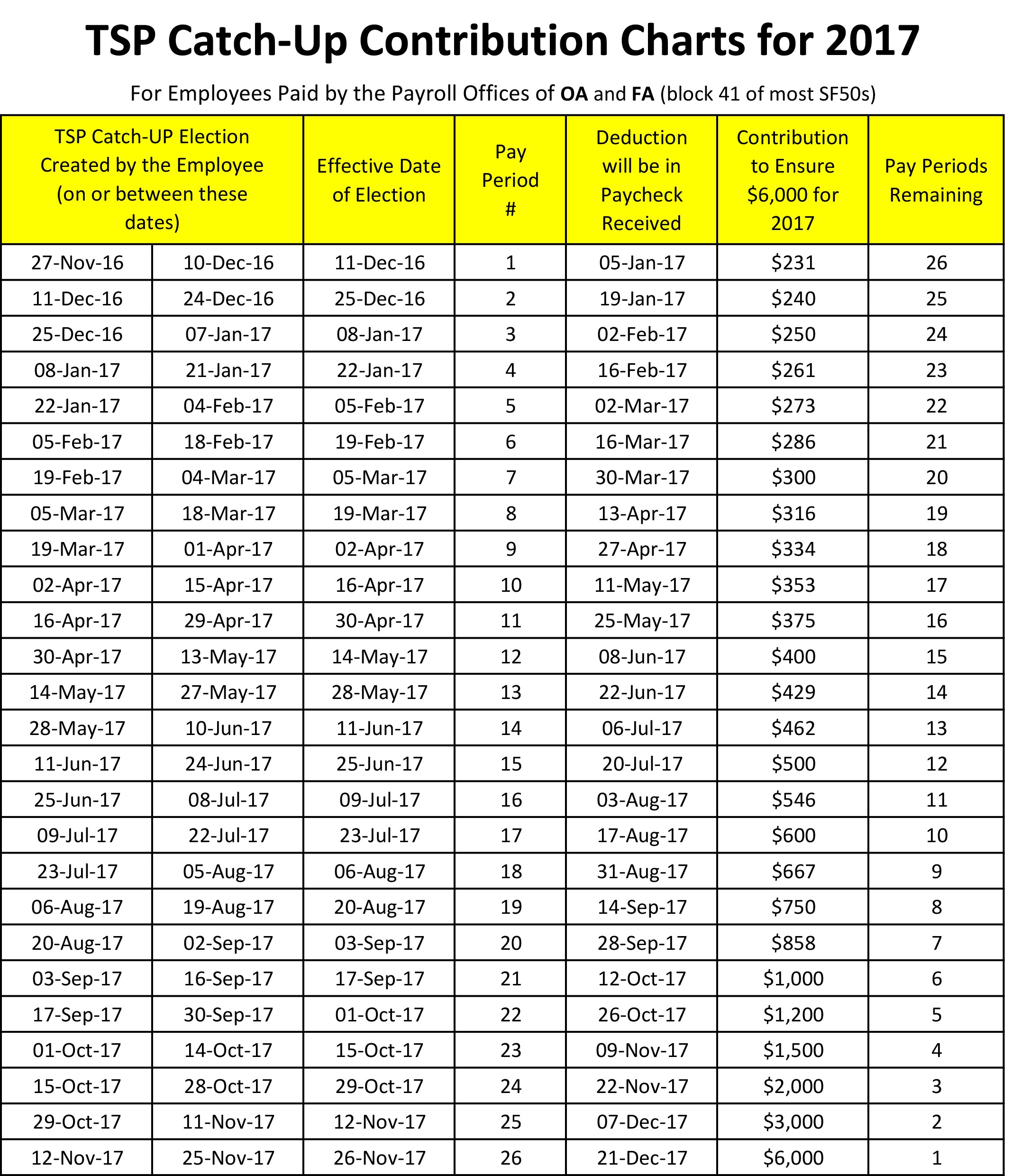

Source: admin.itprice.com

Source: admin.itprice.com

2023 Tsp Maximum Contribution 2023 Calendar, Subject to certain limits, individuals who itemize may generally claim a deduction for charitable contributions made to qualifying charitable organizations. If you aren’t taking the standard deduction , you will likely qualify for tax breaks for charitable donations and strategies that maximize.

Source: www.youtube.com

Source: www.youtube.com

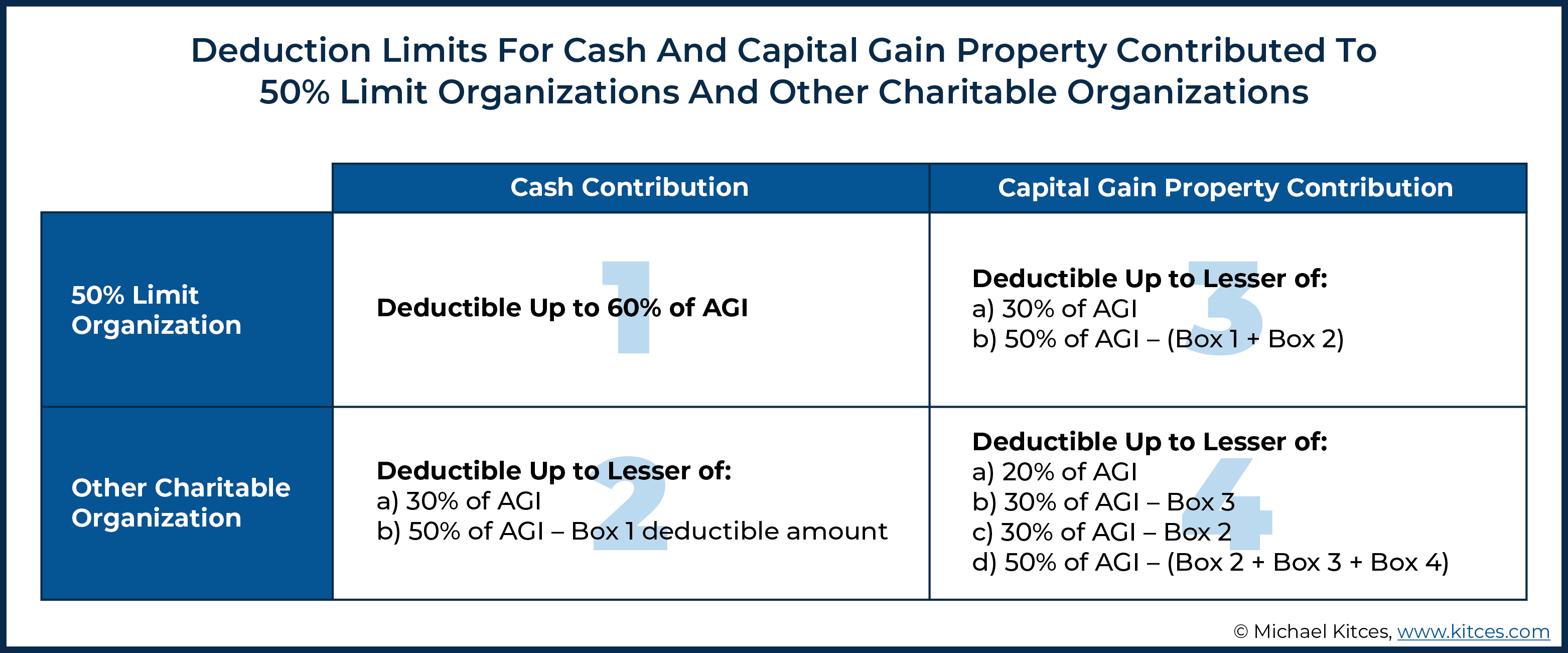

Limits on Charitable Deductions 4 Carryover Deductions (Updated, Each year, the irs adjusts charitable gift rules, tax tables, personal exemptions, standard deductions and other tax. If you aren’t taking the standard deduction , you will likely qualify for tax breaks for charitable donations and strategies that maximize.

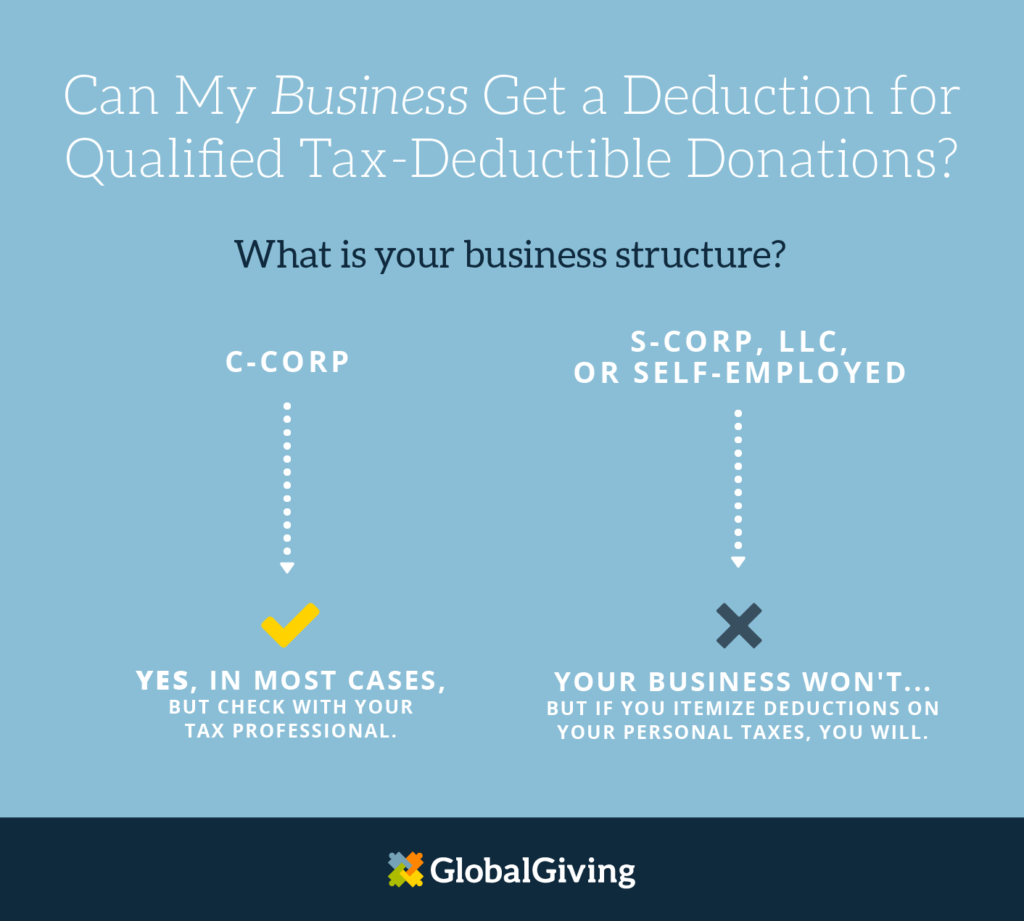

Source: www.globalgiving.org

Source: www.globalgiving.org

Everything You Need To Know About Your TaxDeductible Donation Learn, Each year, the irs adjusts charitable gift rules, tax tables, personal exemptions, standard deductions and other tax. In return for your payment you receive or expect to receive a state tax credit of 70% of your $1,000 contribution.

Source: www.cpajournal.com

Source: www.cpajournal.com

Sweet (and Sour) Charity The CPA Journal, Each year, the irs adjusts charitable gift rules, tax tables, personal exemptions, standard deductions and other tax. Subject to certain limits, individuals who itemize may generally claim a deduction for charitable contributions made to qualifying charitable organizations.

Source: mungfali.com

Source: mungfali.com

Solo 401k Contribution Limits For 2020 & 2021 41C, The changes to charitable contribution deductions in 2024 play a significant role in tax strategy. As a part of the tax cuts and jobs act (tcja), the 60% limitation on cash.

Source: www.kitces.com

Source: www.kitces.com

Why To Avoid 100OfAGI Qualified Charitable Contributions, The limits on charitable contribution deductions can significantly impact an individual’s or business’s tax strategy, making it an essential topic of discussion. Turn charitable donations into big tax deductions with itsdeductible track your donations.

Source: www.howtoquick.net

Source: www.howtoquick.net

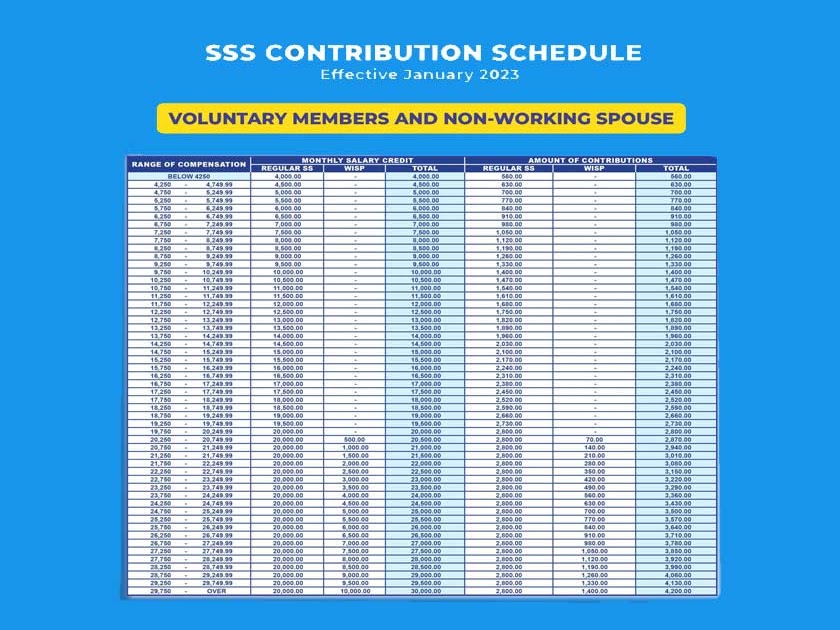

SSS Voluntary Members Contribution Table 2024, Itsdeductible service will continue—2024 donation tracking is now available. Moving into 2024, further changes have been made to the tax laws affecting charitable contributions deductions.

Source: www.crowe.com

Source: www.crowe.com

Limitation on Charitable Contribution Deduction Crowe LLP, To get the charitable deduction, you usually have to itemize your taxes. The limit for appreciated assets in 2023 and 2024,.

If You Aren’t Taking The Standard Deduction , You Will Likely Qualify For Tax Breaks For Charitable Donations And Strategies That Maximize.

Moving into 2024, further changes have been made to the tax laws affecting charitable contributions deductions.

A Corporation Can Claim A Limited Deduction For Charitable Contributions Made In Cash Or Other Property.

To get the charitable deduction, you usually have to itemize your taxes.